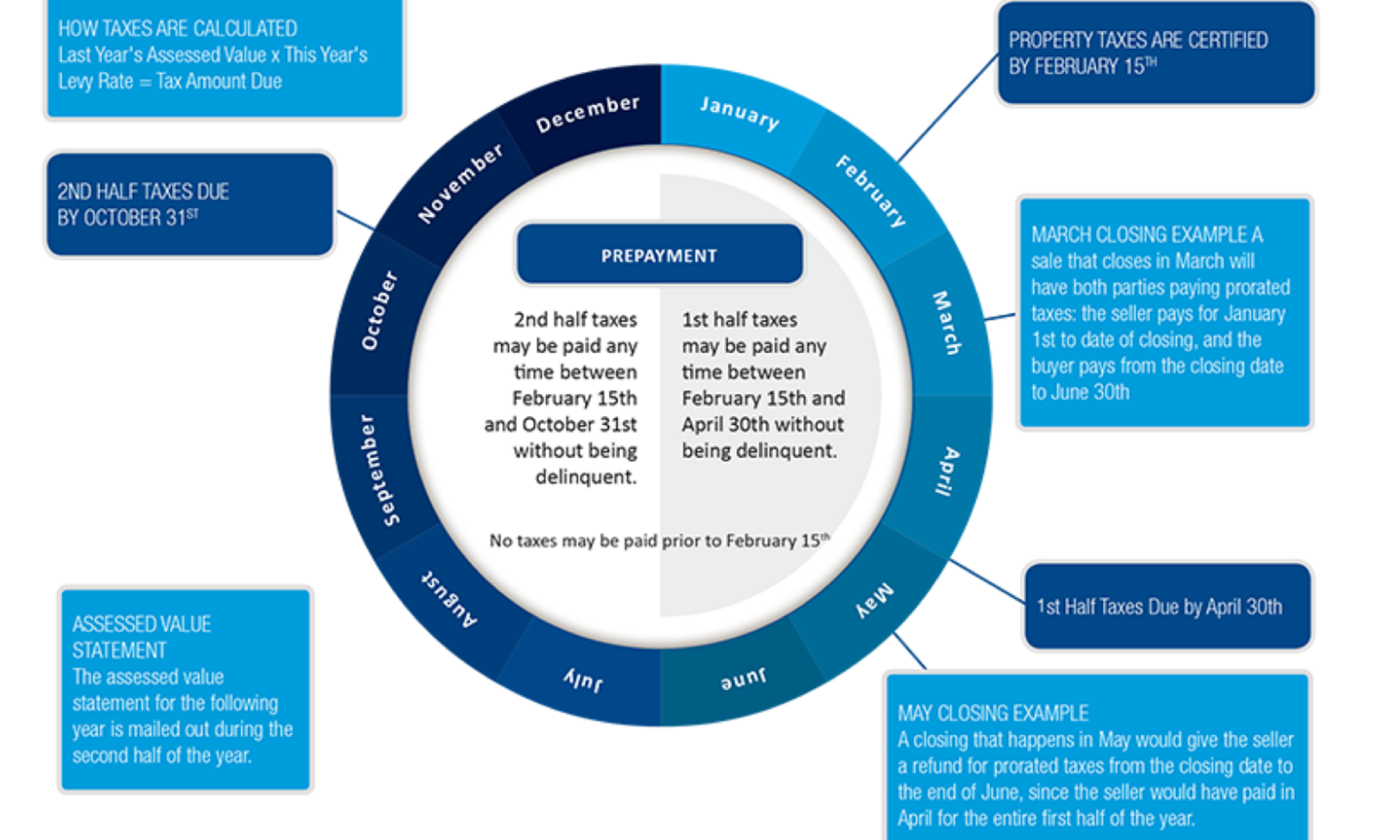

There are few things in life that are as certain as taxes, especially when it comes to buying, selling, and owning real estate. Here’s the scoop on property taxes, including when they are due, when they may be paid, how they’re calculated, and what tax relief programs are available. Property taxes have a timeline that is different than most other taxes or bills that we pay. Let’s take a look at the facts: Taxes are due twice a year, but towards the middle of each cycle. First half taxes are due at the end of April and cover January through June. Second half taxes are due at the end of October, and cover July through December.

Property tax proration

Because taxes are due toward the middle of the period they cover, a real estate seller may receive a refund or pay prorated taxes depending on the closing date. For example, a sale that closes in March will have both parties paying prorated taxes: the seller pays for January 1st to date of closing, and the buyer pays from the closing date to June 30th.For a closing that happens in May, the seller would receive a refund for prorated taxes from the closing date to the end of June, since the seller would have paid in April for the entire first half of the year.