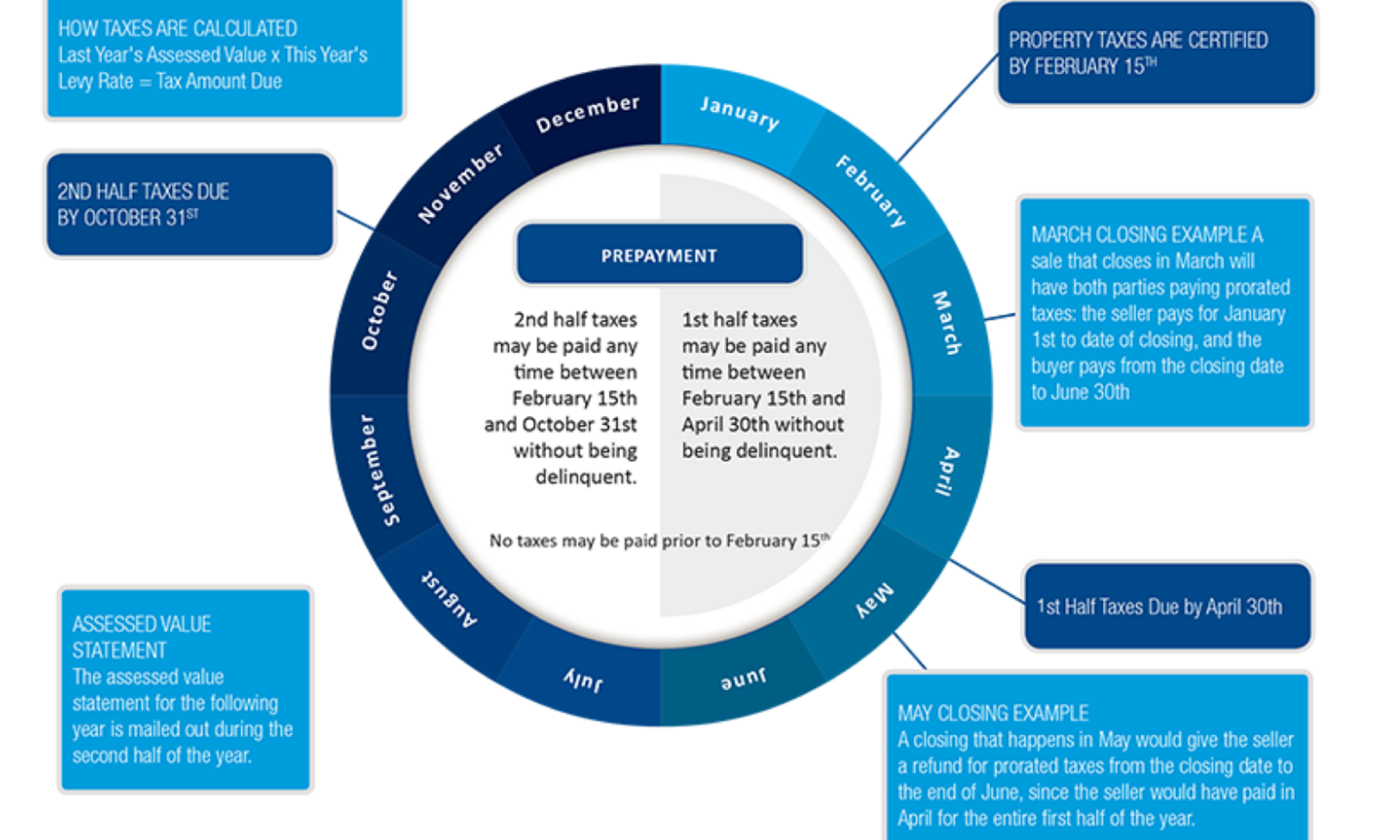

There are few things in life that are as certain as taxes, especially when it comes to buying, selling, and owning real estate. Here’s the scoop on property taxes, including when they are due, when they may be paid, how they’re calculated, and what tax relief programs are available. Property taxes have a timeline that is different than most other taxes or bills that we pay. Let’s take a look at the facts: Taxes are due twice a year, but towards the middle of each cycle. First half taxes are due at the end of April and cover January through June. Second half taxes are due at the end of October, and cover July through December.

Property tax proration

Because taxes are due toward the middle of the period they cover, a real estate seller may receive a refund or pay prorated taxes depending on the closing date. For example, a sale that closes in March will have both parties paying prorated taxes: the seller pays for January 1st to date of closing, and the buyer pays from the closing date to June 30th.For a closing that happens in May, the seller would receive a refund for prorated taxes from the closing date to the end of June, since the seller would have paid in April for the entire first half of the year.

Can property taxes be paid in advance?

Taxes for the second half of the year can be paid in advance, but the first half can’t. Washington State law (RCW 84.56.010) doesn’t allow county treasurers to collect property taxes until February 15 of the year that they are due. So the first half is typically payable any time between Feb 15th and April 30th; and the second half is typically payable any time between Feb 15th and October 31st. It is not necessary to have a tax statement to mail in with your payment. If you decide to mail in your payment without a tax statement, you must write your tax account number on the check. Mailed payments must be postmarked on or before the due date otherwise they will be considered late.

| When are taxes due? 1st half are due the last day of April, 2nd half are due the last day of October. King County mails out a statement in the middle of February (February 14th for this year – Happy Valentine’s Day!) |

Assessed Value & Levy Rate The two factors used in the calculation of taxes are the assessed value of the property and the levy rate for that area. Levy rates are represented in dollars per thousand, so to calculate the tax amount multiply the assessed value by the levy rate and divide by 1,000. |

Last Year’s Assessed Value x This Year’s Levy Rate = Tax Amount Due

What determines the levy rate?

The levy rates are determined by a number of factors, including the results of voter-approved levies. Property taxes usually aren’t certified until the middle of February, even though the assessments were mailed out the previous year (which often causes confusion). In other words, the assessed valuation statement you get in the 2ndhalf of this year has no effect on the taxes you are paying this year. The valuation will be used in the calculation for next year’s taxes. You won’t know the actual tax you will need to pay for 2012 until the county certifies 2012 taxes in the middle of February, even though 2012 assessed values have been available for months.

Assessed value vs. taxable value

The assessed value is typically the same as the taxable value except in cases where the taxpayer has applied for and received an exemption. For example, senior and disabled property owners may qualify for tax reductions. In some cases home improvements may qualify for a 3-year exemption for taxes on the value of the improvement. For more information on possible exemptions or tax deferrals, contact the Assessor-Treasurer for the county in which the property is located.

What tax relief programs are available?

Here are some examples of programs and special classifications available that provide tax relief:

* Open Space Classification for Agricultural land, Timberland, and Natural preserves.

* Designated Forest Land Classification for timberland parcels 20 acres or more.

* Historical Restoration Exemption for historical significant property undergoing restoration.

* Improvement Exemption – Single Family Dwellings a temporary exemption of valuation of additions to single-family dwellings.

* Destroyed Property Claim adjustment to the valuation of destroyed property. (please note this program is handled by the Admin department, for further information please contact them at 425 388-3038).

* Property tax exemptions for senior citizens and disabled persons

* Full tax deferrals for senior citizens and disabled persons.

* Exemptions for qualifying property owned by non-profit organizations.

* Property tax deferral for those with limited income.

Courtesy of Ticor Title