A basic explanation for our soaring home prices in King County

There are a lot more people searching for homes, and far fewer homes available for them to buy, so the primary answer is: There just aren’t enough homes for sale.

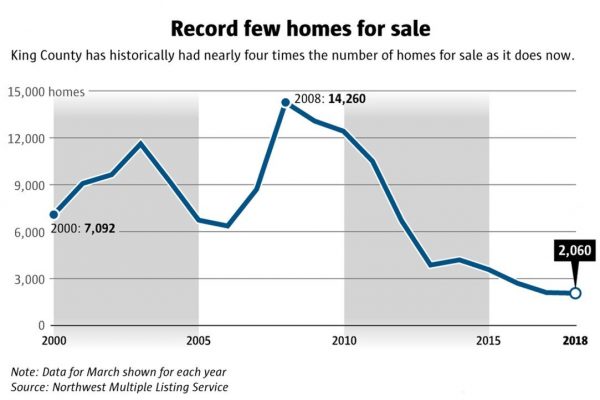

The number of homes on the market is at a low point for records that date back to 2000, despite the big increase in population over that span.

King County had only about 2,000 homes (single-family and condo) for sale last month. During the average month of March over the last two decades, the region had more than 7,800 homes for sale — nearly four times as many.

You may think homeowners would want to cash out: The average homeowner across the metro area who sells today has owned the home for about 10 years and makes a 64 percent profit over what they originally paid, according to Attom Data Solutions. That’s the fourth-biggest return on investment in the country.

The problem is people who are staying in the area would have to turn around and buy in the same crazy market, so only people moving to a cheaper area or downsizing have real financial incentive to sell. A lot of people who want to trade up to a bigger house are just staying put and doing renovations. Seattle-area homeowners wait longer to sell than anywhere else in the country besides Boston; San Jose; Providence, R.I.; and Hartford, Conn.

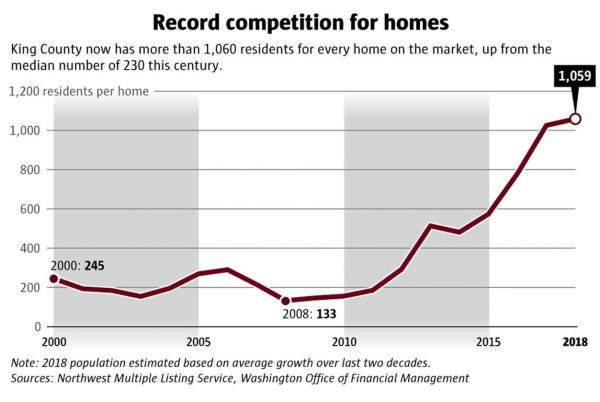

Unfortunately, the supply of homes is only half of the sad equation — demand is rising, too. Since 2000, King County’s population has grown 26 percent. The number of jobs here grew a bit faster — 28 percent, meaning the people moving here often have the financial means to buy a house.

The competition has gotten steeper. Only New York has seen wages grow faster among peer counties since 2000. That’s been driven by tech: The average person with a local computer or math job now makes $113,610, a 22 percent jump from 2000, adjusted for inflation.

Add it all up and you get a lot more people making a lot more money fighting over many fewer homes.

In the typical year over the last two decades, the county had 1 home for sale for every 230 people. Now? There’s one home available for every 1,060 people.

There used to be enough homes on the market for people to more easily find the home they want, pay the asking price or a little less, and be done with it. Now, more people are forced to fight over the few homes available, creating bidding wars that drive prices higher. The losers in the bidding war then get increasingly desperate, bidding up the price for the next home they see, creating a vicious cycle of desperation and bidding beyond what a home “should” be worth.

There are other factors that go into this — like expensive rents that make people more desperate to buy homes, foreign and domestic speculators who buy homes as investments and keep them empty, single-family homes that Wall Street firms bought and converted into rentals during the recession, the fact that very few for-sale homes are being built, and so on. I’ll cover more of those angles in future postings.

But the basic supply-and-demand issue is at the core of why home prices here have grown faster than anywhere else in the country since late 2016. And the worst part is that both trends — falling supply and rising demand — are only getting stronger, but there are signs things may be getting better with a recent as area housing inventory increaed by 14% – but still not expected to be enough to offset the double diget rise in home prices. We will be watching this trend in a future blog post.