SPACER

The ultimate cost of purchasing a home can be a lot more than the price shown on the Purchase & Sales Agreement. At closing, you will incur certain costs and in the first year after closing there could be more.

At closing, you will have to pay for title and escrow fees plus “prepaids and reserves”, which include 1) property taxes for the portion of the semi-annual period after closing that you own the home, 2) homeowners’ insurance for the first year after closing, 3) interest on your loan from the day of closing to the end of that month and 4) your deposit into the lender’s reserve (escrow) account so they can make the next payments of taxes and insurance. Depending on the rate you select for your loan, you may also have to pay some “discount points” for the loan. An alternative is to select a rate at which you will receive back from the lender a “credit’. The amount of credit will be determined by the rate selected, but that approach could reduce the cash required at closing to no more than the down payment.

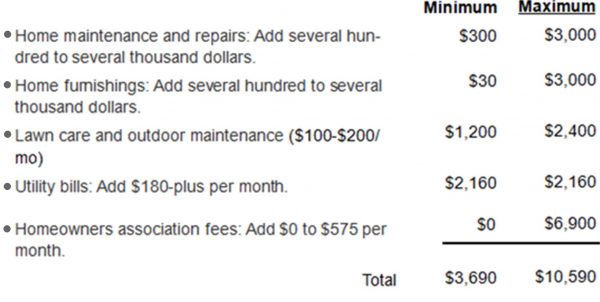

After closing, your monthly loan payment will include a monthly payment for taxes and insurance and, possibly, for mortgage insurance (depending on your down payment). You could incur some unexpected home repairs, monthly utility bills and, if your home is a condo, homeowners association (HOA) dues and assessments.

What price would you offer to buy a new home?

Housing inventories in the greater Seattle area, north and south, and to the east as far as Issaquah, have recently descended to a 22-year low. Mortgage rates are also low, at near two-year lows and getting close to record levels again; this helps fuel demand for a diminishing pool of homes.

If you are having a frustrating time finding a home to buy, I can help you. Simply use the form below to share with me the neighborhood in which you are interested, and the amount you are willing to spend. I will show you every home that meets your requirements and my connections throughout the region provide me access to many potential sellers who may have not yet listed their homes, and those who would consider selling only if they know there is a committed, well-financed, and willing buyer standing by.