True cost

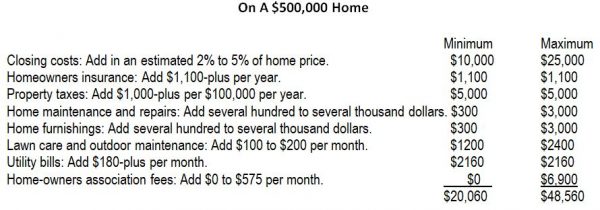

The ultimate cost of purchasing a home can be a lot more than the price shown on the Purchase & Sales Agreement. Along with your new mortgage payment, you probably find yourself needing to fund other upfront and new ongoing expenses. Unexpected home repairs, closing costs, property taxes, utility bills, and homeowners association fees can add hundreds, even thousands, of dollars to your outlay. To acquaint you with the most common expenditures that occur within the first year of home ownership we have the table below, showing the first-year expenses of buying/owning a $500,000 home.

For what price would you make an offer to buy a new home?

Housing inventories in the greater Seattle area, north and south, and to the east as far as Issaquah, have recently descended to a 22-year low. Mortgage rates are also low, at near two-year lows and getting close to record levels again; this helps fuel demand for a diminishing pool of homes.

If you are having a frustrating time finding a home to buy then I may be able to help. Simply use the form below to share with me the neighborhood in which you are interested, and the amount you are willing to spend. My Cascade Team connections throughout the region provide me access to many potential sellers who may have not yet listed their homes, and those who would consider selling only if they know there is a committed, well-financed, and willing buyer standing by.

So, when ready, put my skill and connections to work for you. All it takes is a half-minute investment in the form below.

BUY YOUR HOME

Maximum

SPACER

True cost

The ultimate cost of purchasing a home can be a lot more than the price shown on the Purchase & Sales Agreement. Along with your new mortgage payment, you probably find yourself needing to fund other upfront and new ongoing expenses. Unexpected home repairs, closing costs, property taxes, utility bills, and homeowners association fees can add hundreds, even thousands, of dollars to your outlay. To acquaint you with the most common expenditures that occur within the first year of home ownership we have the table below, showing the first-year expenses of buying/owning a $500,000 home.

table 1

|

On A $500,000 Home |

||

|

SPACER |

Minimum | Maximum |

| Closing costs: Add in an estimated 2% to 5% of home price. | $10,000 | $25,000 |

| Homeowners insurance: Add $1,100-plus per year. | $1,100 | $1,100 |

| Property taxes: Add $1,000-plus per $100,000 per year. | $5,000 | $5,000 |

| Home maintenance and repairs: Add several hundred to several thousand dollars. | $300 | $3,000 |

| Home furnishings: Add several hundred to several thousand dollars. | $300 | $3,000 |

| Lawn care and outdoor maintenance: Add $100 to $200 per month. | $1200 | $2400 |

| Utility bills: Add $180-plus per month. | $2160 | $2160 |

| Homeowners association fees: Add $0 to $575 per month. | $0 | $6,900 |

| Total | $20,060 | $48,560 |

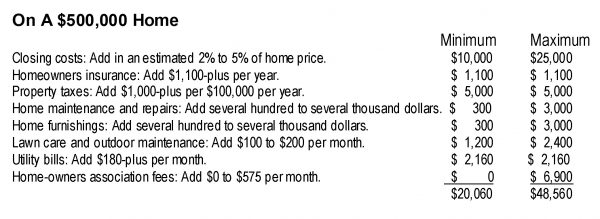

For what price would you make an offer to buy a new home?

Housing inventories in the greater Seattle area, north and south, and to the east as far as Issaquah, have recently descended to a 22-year low. Mortgage rates are also low, at near two-year lows and getting close to record levels again; this helps fuel demand for a diminishing pool of homes.

If you are having a frustrating time finding a home to buy then I may be able to help. Simply use the form below to share with me the neighborhood in which you are interested, and the amount you are willing to spend. My Cascade Team connections throughout the region provide me access to many potential sellers who may have not yet listed their homes, and those who would consider selling only if they know there is a committed, well-financed, and willing buyer standing by.

So, when ready, put my skill and connections to work for you. All it takes is a half-minute investment in the form below.

table 2

On A $500,000 Home

Minimum Maximum

Closing costs: Add in an estimated 2% to 5% of price. $10,000 $25,000

Homeowners insurance: Add $1,100-plus per year. $1,100 $1,100

Property taxes: Add $1,000-plus per $100,000 per year. $5,000 $5,000

Home maintenance and repairs: Add several hundred to $300 $3,000

several thousand dollars.

Home furnishings: Add several hundred to several $300 $3,000

thousand dollars.

table 3